A New Program for Small-Scale Workforce Housing

The Rental Revolving Loan Fund (RRLF) currently on the desks of Vermont lawmakers would supercharge the development of middle-income housing projects, particularly at a smaller scale.

Hey — Jonah here. This is Brick + Mortar where I share insight into the acquisition, financing, design, construction, and operations of my real estate development projects at Village Ventures.

Look ma’, we made it!

… to the cover of a state agency’s proposal for the new Rental Revolving Loan Fund.

If you live in Vermont and/or are interested in housing—which (**checks analytics**) is most of you—then circle ‘round.

Because, either:

You are a Vermonter and the RRLF could have a real impact on adding workforce housing across the state; or

You are a non-Vermonter but will hopefully be inspired by an innovative approach to funding workforce housing (share with your local state rep!)

What is the Rental Revolving Loan Fund (RRLF)?

The idea is simple—to incentivize partnerships between employers and developers by providing favorable debt financing to workforce housing projects.

Projects would need to cater to residents making 65%-120% of the Area Median Income (AMI). Or, between $42,000-$89,000.

In exchange, RRLF would provide up to 35% of development costs as a loan at below-market rates (down to 0% interest at a 30-year amortization).

And best of all—the program does not set a minimum unit threshold for eligibility. This would be a big win for small-scale developers where there’s a real lack of subsidized financing available (see my experience here, here, and here).

The RRLF creates a powerful incentive structure

Employers are having trouble finding housing for staff. Via a joint venture, they can play an active role in solving that problem by becoming equity investors in a workforce housing project.

The RRLF encourages this and provides additional incentive when this occurs.

Employers measure return on investment (ROI) differently from a typical investor. Instead of cash flow and profits, smaller returns (due to lower rents) are justified if it leads to safe, stable housing at rates their employees can afford.

All of a sudden, deals that might not have penciled because of lower profits are suddenly appealing due to the shift in ROI requirements by equity investors.

And, now, workforce housing projects may be even more feasible using RRLF financing. With today’s interest rates eating up the majority of pro forma cash flow on workforce housing opportunities, most ideas don’t get past the napkin. The RRLF changes this by allowing developers to replace high-interest conventional debt with most cost-effective financing.

Plus, there are benefits from a property management standpoint (this is speculation, I’ve never operated a workforce housing project):

Less turnover: Longer tenancies assuming employment is stable

Shorter vacancies: Barring layoffs, the employer should have a waitlist of employees looking for housing. One moves out, another moves in

Fewer repairs: With residents knowing housing is connected to their employer, they’ll be more apt to take care of the space

This leads to lower operating costs, allowing further savings to be passed onto the residents.

I’m excited to test this model out.

I have a 10-unit workforce housing project I’m exploring in Bradford, VT. If you’re a local employer, let’s talk!

State of the housing market in Vermont

The RRLF presentation has some juicy stats.

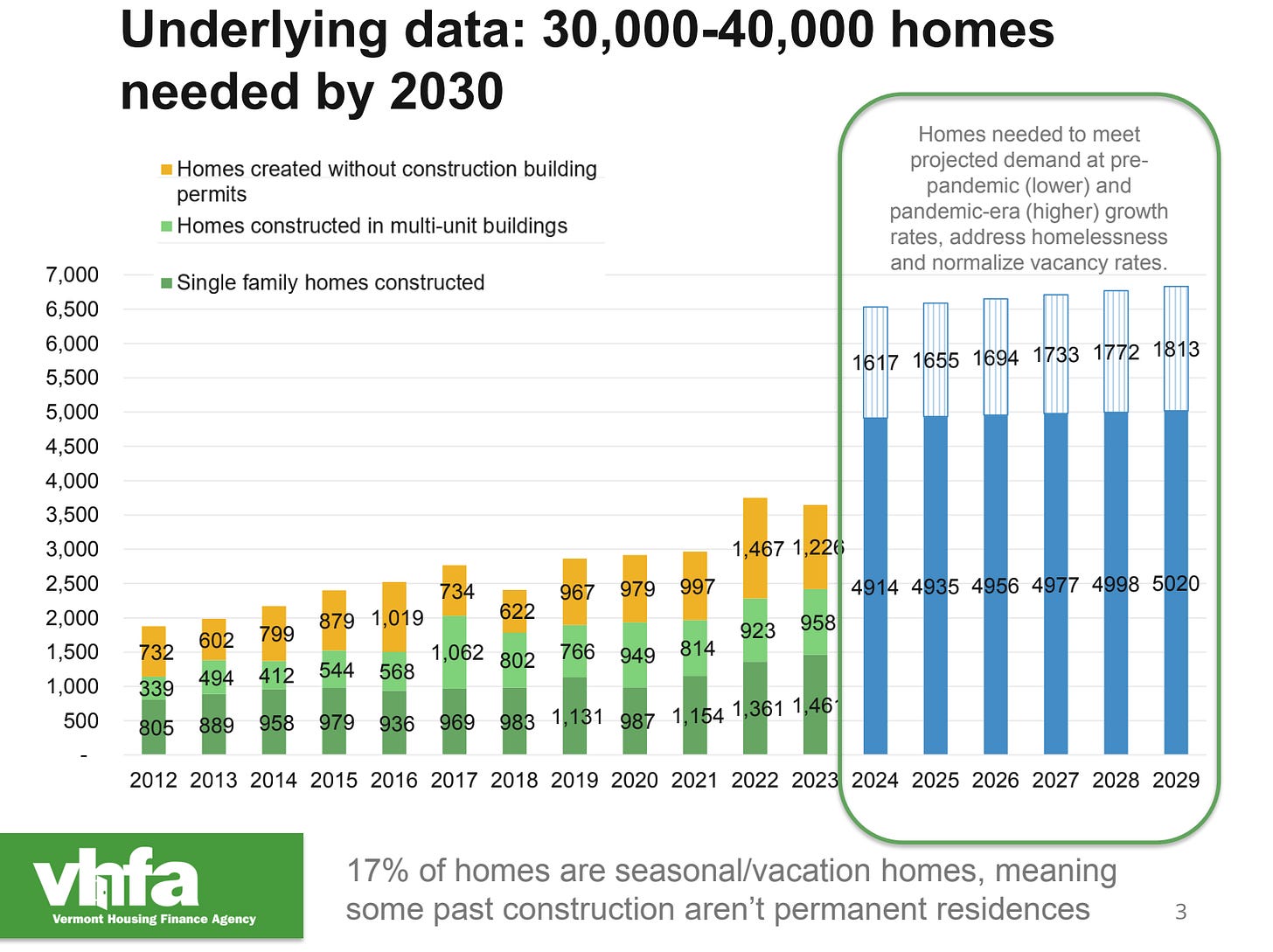

Anecdotal stories on housing supply and demand mismatch are everywhere. But what you don’t see everyday is data depicting the magnitude of the problem.

Well, here ya go:

Vacancy rate isn’t the perfect representation of demand (second homes, STRs, abandoned buildings, etc). But, directionally, I think it works.

And to realize that Vermont is under-building homes by a factor of 40-80%. There is significant opportunity for small-scale developers to fill the void in supply.

It all comes down to price point and affordability of the units delivered.

Unless we want the majority of this gap to be filled by market rate housing, we need programs like RRLF to support lower-income projects.

Until next time.

— Jonah 🧱

ECFiber should be in. Let’s talk you have my info.