Hey. Welcome to the first edition of Small-Scale Sunday from Brick + Mortar where small-scale developers get one actionable tip on acquisition, financing, design, construction, or operations.

** I’ve made a change to content format. If you didn’t see my update yesterday, take a look.

Before I bought my first rental property, I had no clue what went into managing one.

I thought my landlord was pocketing the thousands of dollars I spent on rent and making a killing.

But, having owned and managed several apartment buildings over the past 4 years, I now know just how wrong I was.

And I have the data to back it up.

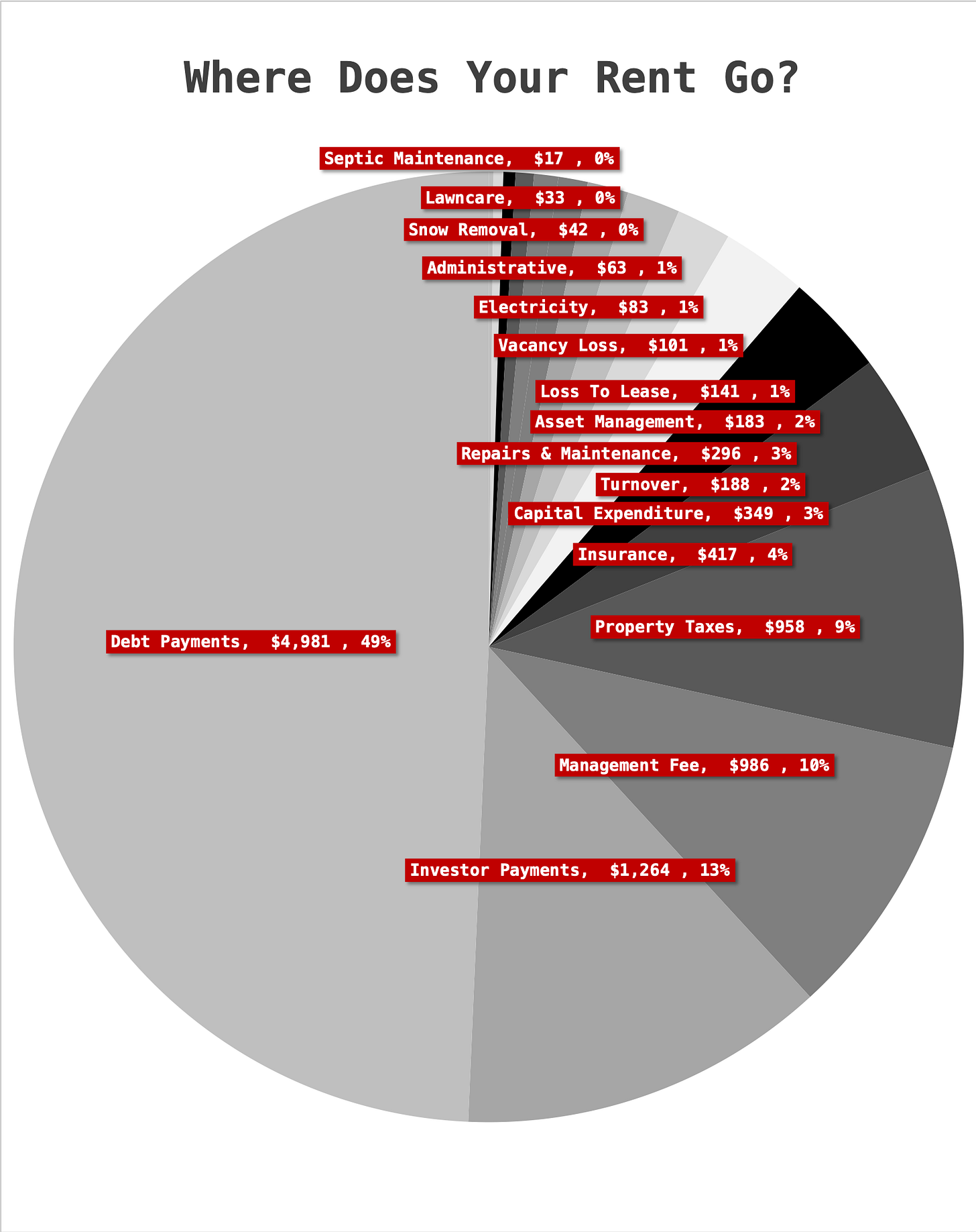

In today’s post, I’ll break down where rent goes—% of profit vs expense—and why you should care about understanding this for your own projects. Using 501 Main as an example.

Let’s dive in.

Here’s the unit mix and projected rent roll for 501 Main.

$10,100 per month in gross rents.

For most people, that prompts 1 of 2 thoughts:

Good for him. That’s a great investment, he could retire off of that; or

Holy s***, he’s price gouging residents. What a slumlord

Both are wrong.

Here’s where all that money actually goes (hint: not to me).

I’ll give some context:

Septic maintenance, lawn care, snow removal: Self-explanatory I think

Administrative: Annual tax prep

Electricity: Each unit pays its own electricity, but there’s one meter for common areas (exteriors, hallways, parking lot) that I pay for

Vacancy loss: Apartments will occasionally sit vacant

Loss to lease: Fee I pay my property manager to lease a vacant apartment ($750 per turnover)

Asset management: Fee I pay myself to manage property financials, handle billing, oversee property manager (2% of net operating income)

Repairs & maintenance: Normal wear and tear

Turnover: Cost to prepare vacant apartment for next resident (painting, cleaning, etc)

Capital expenditure: Escrowed funds for big items like roof replacement

Insurance & property taxes: The usual

Management fee: Fee I pay my property manager to handle day-to-day operations (10% of collected rents)

Investor payments: Dividends paid to investors in exchange for their equity investment. With $400,000 coming from investors, these payments represent an annual dividend of 3% (this is called the cash-on-cash return). Consider this the cost of equity capital (i.e. an expense)

Debt payments: Principal and interest charges on the project’s $800,000 loan (65% LTV)

Half of rent going to pay off debt is A LOT.

Like, a lot A LOT.

25-40% is common in my experience. So why is 501 Main so high?

New construction. Materials and labor are at an all-time high. The cost of everything has skyrocketed, meaning it now costs more on a per SF basis to build the same building

High performance building. 501 Main will exceed state energy code and use highly efficient systems that are not yet standard practice. The techniques used to deliver such a building (i.e. exterior insulation, mechanical ventilation, air sealing, all-electric systems) require top-of-the-line materials and skilled labor to do right

And so, coming full circle, you don’t see any developer profits in the pie chart.

That is, yours truly isn’t cashing checks hand over fist here.

Typically, a portion of rents would go to the developer as compensation for the risk and effort to take the project from zero to something.

But, I chose to structure a deal where my earn out happens over a longer time horizon. And only once those who entrusted me with their equity capital are paid a reasonable return. Without them, this project would still be a pipe dream.

Alright, so why should you care?

As a small-scale developer, you need to know where your revenue is being spent.

A pro forma is the starting point. But visualizations like the above are useful for communicating. Particularly to investors and the community.

You can identify areas that are higher than average (in my case, debt) and make adjustments as needed. For me, that’s doing everything I can to shave construction costs and drive efficiency on site.

This will also inform whether you can afford to include utilities. Which we can’t without significantly raising rents.

Equally important is managing public perception. It’s easy for folks that don’t live and breath real estate to jump to conclusions of the greedy landlord. A visual provides an opportunity to educate and set expectations.

And lastly—want a copy of the pro forma I built for 501 Main? Shoot me a note by replying to this email and I’ll send it to you.

Until next week,

— Jonah

P.S. Want to connect? Find me on LinkedIn and my projects on Instagram.

This is really interesting, thank you. What's the timeline on when you can start lowering or eliminating the debt service and investor payments so that you do make more of an ROI on this. Five years? Twenty?