Hey — Jonah here. This is Brick + Mortar where I share insight into the acquisition, financing, design, construction, and operations of my real estate development projects at Village Ventures.

**clap clap**

If you’re sleeping on pocket neighborhoods, wake up.

Maybe you’ve never heard of them. Or perhaps you don’t get why they’re so great. Or you’re just not sure if they’ll pencil.

Let’s clear all that up.

What are pocket neighborhoods and why should you care?

Most people enjoy being part of a community.

Not the fake marketing kind used by real estate developers to charge more rent.

But like a real community. The sense of belonging where you know your neighbors and be part of a social network with other members. Maybe share interests, attitudes, or goals.

Pocket neighborhoods attempt to facilitate community using a different approach to development.

Instead of one big building, you’re talking a mix of single-family, duplex, and smaller multifamily buildings. All centered on shared amenities—think garden, event space, BBQ pits, etc.

They’re a phenomenal way to drive dense, infill development at smaller scales.

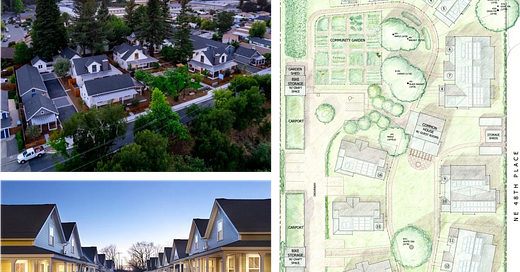

Here are some examples:

What’s not to like, right?

The big question is—how many units can/should you put on a parcel of land?

Well, here’s what those three projects above did:

RiverHouse: 1.2 acres with 8 homes and 4 ADUs = 10 dwelling units per acre (du/ac)

Cully Grove: 1.9 acres with 16 units = 9 du/ac

Cottages On Greene: 0.85 ac with 15 units = 18 du/ac

AKA gentle density.

For reference, your typical single-family house in an R-1 zone on half an acre gets you 2 du/ac.

Ok, so now that you have a bit of context, let’s jump into a case study.

Case study in Fairlee, VT

I’m going to use Fairlee because that’s where I’m currently building 501 Main and I have better context into costs, rents, geography, etc there.

Here’s a parcel:

I don’t know the owner. I don’t know if it’s for sale. I just know that it’s a good location and a good zone.

The parcel is 3.7 acres. To be safe, let’s assume we build at 8 du/ac, or 30 units. Fairlee doesn’t have a sewer system so we’ll go a bit lower on density than the above examples to account for on-site septic.

Pretend we make a deal with the owner to purchase it for $200,000.

Now, the pro forma (if you want an editable copy, shoot me an email):

A $6m project, or $200,000/unit. Again, in theory.

My approach was simple:

Enter development costs, operating expenses, and debt service based on local market knowledge

Back into unit sizes and rents using two target metrics:

Unlevered yield on cost (UYOC): Ratio of net operating income to total project cost. Target 8%

Cash-on-cash (CoC) return for Limited Partners (LPs): Annualized dividend paid to investors. Target 6%+ or else difficult to find equity partners

In summary—I kept raising rents until the project hits both UYOC and CoC metrics.

Then, we validate.

$1,450/mo for a studio in Fairlee is steep. Too steep. At 501 Main, we’re at $1,300/mo and that’s pushing it.

Maybe further south in White River Junction. But not Fairlee.

Same with the 1-BRs and 2-BRs ($1,850/mo and $2,250/mo).

No one would rent those.

So we scrap the project and move on.

NEXT.

Unless… what if we got some subsidy?

Remember that Rental Revolving Loan Fund (RRLF) program I mentioned last time? Let’s assume that comes through for us. Then sprinkle in some of the same affordable housing subsidy I received for 61 N Pleasant.

And because the RRLF is for workforce housing, we partner with a local employer who kicks in $250,000 in equity in exchange for right of first refusal on all apartments and a piece of the upside.

Let’s see—

Now we’re talking.

$900/mo for a studio is worth getting excited over.

Our Limited Partner (LP) investors stay happy with their 6+% cash-on-cash return. Residents are content with lower rents. And our partner employer has a stable housing option for local employees.

Sign. Me. Up.

One caveat—there are a number of assumptions in the above pro formas. Build costs, debt terms, grant availability, partnership structures, etc. All are best guesses from what I’ve seen in today’s market.

Nonetheless, a great exercise.

What does it all mean?

Put simply—a project like this in a town like Fairlee does not get built anymore without public subsidy. The achievable rents just can’t support the costs.

If we were to insert actual market rate rents in that first, unsubsidized example, the project would still make money. But not nearly enough to attract equity investment.

And no equity investors = no building.

In other words—the market rate rents in Fairlee are lower than what the project would require to get off the ground.

Comparing the two pro formas, however, it’s clear how subsidy changes the economics.

When public funding is available, less capital needs to come from equity investors. In turn, this relaxes the amount of cash flow they require as a return on investment.

Ultimately, this savings translates into lower rents.

So, to summarize—

Pocket neighborhoods are amazing concepts

In areas like Fairlee, they do not pencil as market-rate projects

BUT, they work well if paired with government subsidy

Queue plug for increasing appropriations for housing subsidy programs.

Until next time.

— Jonah 🧱

P.S. Want to connect? Find me on LinkedIn.

I found Ross Chapin/ Architect and Author of "Pocket Neighborhoods" about 7years ago and fell in LOVE! I've sent his book to 2 of our city council members and 1 local developer here in Northwest FL. Everyone runs around and screams we can't make the #'s work...we can't build these types of communities...at the end of the day it comes down to profit margins...how little are the developers willing to accept and how much is the community willing to give. Thank you for sharing the pro forma , it's good info.

Except...maybe climate refugees plus the availability of multigigabit symmetrical FTTP from a local special-purpose municipality...makes higher rents achievable. Seems like Fairlee with an interstate and tremendous rec opportunities will be utterly transformed over the next 10-20 years (like it or not).